Remit2Any Detailed ReviewRates, Fees, Limits, Safety and More

Last updated: April 12, 2025

What is Remit2Any? An introduction

Remit2Any is a reliable and secure money transfer service designed specifically for Non-Resident Indians (NRIs) in the USA. It provides a simple, efficient, and cost-effective way to send money to India, offering a seamless transfer process with a focus on security and speed.

Launched in January 2022, Remit2Any has quickly established itself as a trusted service for NRIs looking for a better alternative to traditional remittance platforms.

The platform offers zero-fee transfers, ensuring that users can send money without worrying about hidden charges. Additionally, it provides competitive exchange rates to maximize the value of each transaction. Remit2Any allows high transfer limits, accommodating both small everyday transfers and large, high-value remittances.

Whether sending money to support family, manage investments, or pay bills, Remit2Any is designed to provide a smooth experience with its focus on transparency, speed, and customer care. 24/7 customer support ensures that users have access to assistance whenever needed, making it a reliable choice for all your remittance needs.

Remit2Any company information

- Company Name: Remit2Any

- Company Headquarter: Seattle, USA

- Established: January 2022

- Website: Remit2Any

- App Availability: Yes (Google Play Store, Apple App Store)

- Customer Support: 24/7 Support via WhatsApp (+1 866 421-4888) or Email (help@remit2any.com)

Remit2Any by the numbers

- Transfer Limits: Remit2Any offers high transfer limits to accommodate both small and large transactions.

- Per Transaction: Up to USD 5,500

- Per Day: Up to USD 15,000

- Per Week: Up to USD 50,000

- Per Month: Up to USD 200,000

- Currencies Available: Currently, Remit2Any facilitates transfers from USD to INR only, which covers the primary need for NRIs looking to send money to India.

- Transfer Speed: Remit2Any ensures instant transfers for most transactions, ensuring that funds are delivered swiftly and reliably. While transfer times may vary slightly depending on the recipient's bank, Remit2Any is committed to providing fast and seamless service.

Remit2Any is a fintech company that specializes in US to India international money transfers at competitive exchange rates and fast speeds.

What services does Remit2Any provide?

Remit2Any provides international money transfers from the United States to India. Check out the below sections to know a lot more about Remit2Any's international remittance service and related aspects.

Which countries does Remit2Any operate in?

Currently, Remit2Any operates exclusively between the USA and India. This specialized focus allows Remit2Any to streamline its service and offer more personalized support to NRIs, ensuring that every transaction from the USA to India is handled with efficiency and care.

Where can I send money from with Remit2Any?

You can send money with Remit2Any from the United States.

Where can I send money to with Remit2Any?

You can send money to India using Remit2Any.

Remit2Any offers international money transfers from the USA to India.

What are Remit2Any's fees and exchange rates?

Remit2Any offers fixed exchange rates, providing users with a guaranteed rate that will not change during the transfer process. Their competitive exchange rates ensure that users get the most favorable value for their money when sending funds to India.

When it comes to fees, Remit2Any operates on a zero-fee policy, meaning there are no transfer fees, hidden charges, or setup fee. This makes it easier for users to send money without worrying about additional costs.

Are Remit2Any exchange rates good?

Yes, Remit2Any offers highly competitive exchange rates in the market that are designed to give users the most value for their money.

Unlike other platforms that might have fluctuating rates, Remit2Any ensures that users receive the best possible rate available at the time of the transaction. This commitment to providing competitive exchange rates ensures that users can trust they are getting the most favorable deal with every transfer.

That said, we always suggest to our readers to always shop around and see what other remittance service providers are offering. More information will help you best choose a partner to send money with. When you compare money transfer providers, the chances of your getting the most benefit on your international money transfers increase significantly.

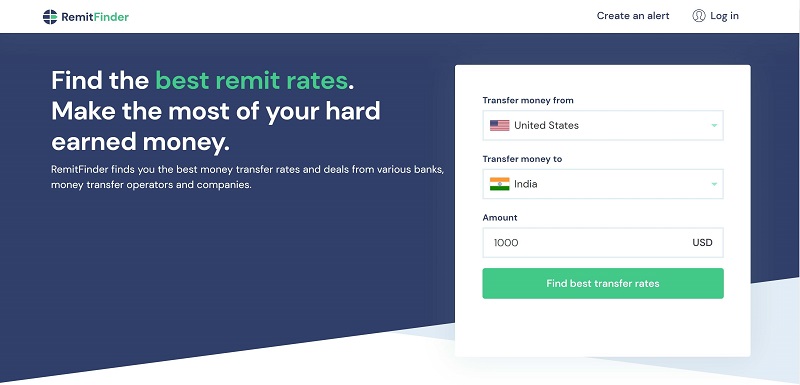

Whilst you can compare remittance companies manually, a quick and convenient way to do so is to rely on RemitFinder's online money transfer comparison engine. RemitFinder compares umpteen providers side-by-side to give you accurate and updated information about exchange rates and deals.

Is Remit2Any a cheap way to send money overseas?

Yes, Remit2Any is an affordable way to send money overseas, particularly because there are no fees associated with transfers.

Unlike many other money transfer services that charge hidden fees or high transfer costs, Remit2Any offers a zero-fee transfer model, meaning users can send more money without worrying about deductions.

Additionally, Remit2Any provides competitive, fixed exchange rates in the market, ensuring that users get the most value for their transfer.

With zero fees and competitive exchange rates, Remit2Any stands out as one of the most cost-effective options for sending money to India.

How do I avoid Remit2Any fees?

Remit2Any has a zero-fee policy for all transactions, meaning there are no fees to worry about when sending money.

What you send is exactly what your recipient will receive, no hidden charges, no deductions.

Therefore, you do not need to take any extra steps to avoid fees, as they simply will not be charged for the transfer. This makes Remit2Any an excellent choice for anyone seeking a straightforward, fee-free way to transfer money to India.

How much money can I send with Remit2Any?

Remit2Any offers high transfer limits to accommodate both small and large transactions.

- Per Transaction: Up to USD 5,500

- Per Day: Up to USD 15,000

- Per Week: Up to USD 50,000

- Per Month: Up to USD 200,000

These limits allow users to send large sums of money without needing to break up transactions into multiple smaller transfers, ensuring flexibility.

How long does it take for Remit2Any to send money overseas?

Remit2Any can move money overseas rather quickly.

Transactions within Remit2Any's instant limit are finished under 30 mins. Transactions where the sending amount is greater than the limit complete within one business day.

How can I pay for my Remit2Any money transfer?

To be able to complete an international money transfer, you first need to send your funds in local currency to the money transfer company you choose. The mechanism to pay for your remittance transaction is called a payment method.

Payments for Remit2Any money transfers are made directly from your bank account.

Which payment method should I use to pay for my Remit2Any money transfer?

Remit2Any supports a single payment method which is your bank account. When you are ready to send money with Remit2Any, simply pay for your international money transfer directly from your bank account.

How can my recipient get paid with Remit2Any?

The method you choose to credit your overseas receiver is generally called a delivery method.

Remit2Any international money transfer recipients can receive funds directly into their Indian bank account.

Which delivery method should I use for my Remit2Any money transfer?

Remit2Any only supports bank account transfers. When you create your international money transfer with Remit2Any, simply choose bank deposit as your delivery option.

Are there any Remit2Any coupon codes or promotions I can use?

RemitFinder customers who use Remit2Any can take advantage of a welcome, promotional exchange rate for the first USD 500 of their international money transfer.

If Remit2Any runs any offers or promotions in the future, we will add them on this page. Check this Remit2Any review periodically to ensure that you do not miss out on any future deals.

Whilst you can check for Remit2Any deals and discounts manually, doing so is time consuming. A better way is to sign up for the RemitFinder daily exchange rate alert. Our daily alert is totally free of cost; we will keep you posted on exchange rates and latest offers from many money transfer companies.

How can I find Remit2Any near me?

Remit2Any operates entirely online, so there are no physical locations.

Users can easily access and use Remit2Any services through the website or mobile app, available on both the Google Play Store and Apple App Store. This enables users to send money from anywhere, without the need for a physical presence or location.

What is the best way to find a Remit2Any Sending Location near me?

Remit2Any does not have physical offices or locations. Simply use their website or mobile apps to send money abroad.

What is the best way to find an Remit2Any Payment Location overseas?

With Remit2Any, your recipient receives money directly into their bank account. Hence, there is no need to go to any payment location to pick up the funds.

Is Remit2Any a safe way to send money abroad?

Remit2Any has many measures in place to ensure the safety and security of their customers' funds and personal information. Below, we present some of these.

- Remit2Any uses 256-bit encryption to safeguard your personal and financial data.

- All payment information is tokenized by a PCI-DSS-certified payment processor to protect sensitive data.

- Your funds are held with an FDIC-insured bank in the United States. Partner’s Money transmission Registration Number: 31000246961737.

- Remit2Any follows Know Your Customer (KYC) protocols to ensure the account is created and accessed by the rightful owner. As part of KYC, your identity is verified using Prove, a trusted and advanced authentication system used by top institutions to reduce fraud.

- Each transaction goes through three layers of security, including OTP (One-Time Password) checks, IP monitoring, and sanctions screening.

- You can also enable Two-Factor Authentication (2FA) for an extra layer of security when logging in to your Remit2Any account.

Remit2Any implements numerous layered protections and security protocols which are designed to give you peace of mind when transferring money internationally with them.

Can I trust Remit2Any?

When evaluating a financial service, it is important to understand its legal standing and regulatory compliance. Here is what you should know about Remit2Any:

- The legal name of the company is Remit2Any Inc., registered in the State of Washington, USA, with registration number 604871470. The company's registered address is 3206 93rd PL SE, Everett, WA 98208.

- Remit2Any is a legally recognized financial service provider and operates in compliance with relevant regulations.

- The brand Remit2Any is a registered trademark.

Remit2Any is committed to maintaining transparency, security, and compliance in every transaction to ensure your money and trust are well-placed.

Does Remit2Any protect my personal data?

Absolutely. Your data security is Remit2Any's top priority, and here are some ways they protect it:

- Remit2Any never stores full card or bank details on their servers.

- All sensitive payment data is tokenized and managed by a PCI-DSS-certified payment processor.

- Personal information is encrypted and securely stored in compliance with U.S. data privacy laws.

What happens if something goes wrong with my transfer?

Remit2Any offers full tracking for every transaction. If an issue arises:

- Remit2Any support team is available to assist you quickly via chat or phone or email.

- If the transfer fails, your funds are returned securely.

- You receive real-time status updates and notifications about your transfer progress.

How do I know I am sending money to the right person?

As part of Remit2Any's KYC process, they verify your identity and gather necessary details about the recipient. You will always receive a final confirmation screen before sending, and we cross-check key identifiers like IFSC code, bank name, and recipient name.

Can I enable extra protection for my Remit2Any account?

Yes. You can enable Two-Factor Authentication (2FA) for an added layer of security during login. Remit2Any also monitors account logins and notifies you of any suspicious activity.

How good is Remit2Any's service?

One of the most reliable ways to check if a service is good or not is to see what other customers have to say about it. We will do the same to see if Remit2Any's customers are happy with their service or not.

What do users have to say about Remit2Any?

In this section, we look into Remit2Any's ratings and reviews^ on popular review platforms and major mobile app stores to see what users think about their service.

- On Trustpilot, Remit2Any is rated 4.5/5.0 with 29 reviews

- On the Google Play Store, Remit2Any has no ratings yet and has more than 500 downloads

- On the Apple App Store, Remit2Any is rated 3.3/5.0 with 7 ratings

^Ratings on various platforms as on April 12, 2025

Remit2Any has very good ratings and reviews on Trustpilot. Mobile app stores ratings are very few since the app is relatively new.

Have you used Remit2Any yet? If so, please consider leaving a review on RemitFinder so other users can benefit from your expertise and experience.

Is Remit2Any the best choice for me?

Given our detailed analysis of Remit2Any international money transfer service and related aspects, it is clear that Remit2Any has many strengths. Here are some areas where we find Remit2Any standing tall in the international remittance use case:

- Focus on US-India corridor: Remit2Any is currently focused on the US-India remittance corridor. This makes their service more attuned to the unique needs to this single market and helps them offer the best possible service.

- Generous transfer limits: Remit2Any offers generous transfer limits, thereby allowing you to send larger sums of money abroad.

- Welcome exchange rate: RemitFinder users get a higher, welcome exchange rate on the first USD 500 of their first money transfer with Remit2Any. This helps you maximize the reach of your hard-earned money.

- Fee free transfers: Remit2Any does not charge any transfer fee. This means that all of your transfers are totally fee free with Remit2Any.

- Bank to bank transfers: Remit2Any supports bank transfer as its sole payment as well as delivery method. This essentially means that the money moves from your local bank account to your recipient's bank account in their country, albeit at competitive exchange rates and 0 fees.

- Safe and secure provider: Remit2Any implements numerous security protocols and best practices to ensure that your money as well as confidential information are safe with them.

RemitFinder likes Remit2Any for providing competitive exchange rates, 0 fees, higher transfer limits, a special exchange rate for new RemitFinder users and a safe and secure financial platform to send money to India.

If you are an NRI looking for a fast, secure, and cost-effective way to send money to India, Remit2Any is a very good choice. The platform stands out with its zero-fee transfers, competitive exchange rates, and high transfer limits, making it ideal for both small and large transactions.

Additionally, with 24/7 customer support, users have access to assistance whenever they need it. Whether you are sending money to support your family or making business transactions, Remit2Any ensures a seamless remittance experience, offering the best value and security.

What are the best reasons to use Remit2Any?

Remit2Any's key advantages make it a very good choice for quite a few international money transfer use cases. Based on the in-depth analysis that we have conducted on Remit2Any's remittance service in prior sections of this review, we notice that it can be a great fit for many international money transfer scenarios.

Here are some examples where Remit2Any can prove to be a reliable ally for your next overseas funds transfer.

- Remit2Any charges zero fees for transfers, ensuring that users can send more money without losing value to hidden costs.

- Remit2Any provides competitive exchange rates in the market, ensuring that users get the best value for their transfers.

- Transfers are processed quickly, allowing recipients to access funds in a short time, which is crucial for urgent transfers.

- Whether sending small or large sums, Remit2Any accommodates both, with high transfer limits for everyday and high-value transactions.

- With encryption and fraud protection, Remit2Any ensures that all transactions are safe and secure.

- Users have access to dedicated customer support at any time, ensuring that any issues are resolved promptly.

Remit2Any's strengths and advantages make it a very good choice for many money transfer scenarios for remitting money to India.

These features make Remit2Any a standout option for anyone looking to send money from the USA to India with ease, transparency, and peace of mind.

What type of transfers can I make with Remit2Any?

With Remit2Any, you can send money internationally from United States to India at competitive exchange rates and with 0 transfer fees.

What are various ways to send money with Remit2Any?

You can place your Remit2Any international money transfer orders in a variety of ways that include the below options:

- Website

- Android mobile app

- iOS mobile app

How to send and receive money with Remit2Any?

It is quick and easy to send money internationally with Remit2Any. In fact, the whole flow from start to finish can be completed on any of Remit2Any's channels to send money with in just a few minutes. Check out the section below for the exact steps needed to do an overseas money transfer with Remit2Any.

Step by step guide to send money with Remit2Any

With Remit2Any, sending money overseas takes only a few clicks. Here are the steps you need to undertake to finish an end-to-end money transfer with Remit2Any:

- Step 1: Decide if you want to send your next money transfer with Remit2Any. With the recent explosion of money transfer operators, it may seem daunting to even choose who to go with. One helpful way to reach a decision is to compare various money transfer companies using RemitFinder's real-time money transfer comparison platform. RemitFinder does all the heavy lifting to assist you to easily compare the relative strengths and weaknesses of many remittance companies side by side. This can really help you to narrow down the choices that meet your selection criteria and therefore, help you to select who to go with.

- Step 2: Sign Up and Verify Your Account. Once you have decided that Remit2Any is the right choice for your needs, create a Remit2Any account and verify your email address and phone number to secure your account.

- Step 3: Complete KYC Verification. Complete the KYC verification for both your US and Indian accounts to ensure a smooth and compliant transfer process.

- Step 4: Add Your Bank Accounts. Link your US bank account and the Indian bank account of your recipient for easy fund transfers.

- Step 5: Initiate the Transfer. Go to the Transfer page, enter the amount, and confirm the transaction details. Your funds will be sent to the recipient’s Indian bank account instantly.

It is quick and easy to send money overseas with Remit2Any. The whole process takes a few clicks only.

How can Remit2Any help me send money?

Remit2Any can help you send money from US to India. It is quick and easy to do so; check out our step-by-step guide to send money abroad with Remit2Any presented in a prior section.

If you still need assistance, Remit2Any's helpful customer support team is available to answer any questions and guide you through the transfer process.

Do I need a Remit2Any account to receive money?

No, you do not need a Remit2Any account to receive money. Funds can be directly deposited into your Indian bank account without requiring you to sign up or register with Remit2Any.

Does Remit2Any have a mobile app?

Yes, Remit2Any is available on both the Apple App Store and Google Play Store, allowing users to easily manage their money transfers directly from their smartphones. The app offers a seamless and convenient way to send money from anywhere, anytime.

How do I track my Remit2Any transfer?

Remit2Any will keep you posted about the status of your international money transfer with them. You can also go to the transaction history section of your account and look for your transfer in progress to see the latest status.

Can I use Remit2Any for international bank transfers?

Since Remit2Any supports bank transfers, the funds move from your local bank account to your recipient's bank account in India. This effectively means that your transfer is similar to an international bank transfer, albeit at Remit2Any's competitive exchange rates and 0 fees.

Is Remit2Any online better than sending money in-person in stores?

Remit2Any is an online only money transfer company, and there are no stores or physical locations to go to. In that sense, Remit2Any is always close to you, accessible via your computer or smartphone.

Does Remit2Any have a rewards program?

Yes, Remit2Any offers a Referral Program that allows both the referrer and the referee to earn INR 1000 for each successful referral.

This program provides users with the opportunity to earn rewards by referring new customers to Remit2Any, enhancing their money transfer experience.

What customer support options are available with Remit2Any?

In case you need any help with your Remit2Any money transfer, or have any other general questions, you can contact the Remit2Any customer support team.

There are a few easy ways to get in touch with Remit2Any customer support as below:

- WhatsApp: +1 (866) 421-4888

- Email: help@remit2any.com

You can reach out to the support team anytime for quick and reliable assistance.

Can I cancel my Remit2Any transfer?

Yes, you can cancel your transfer as long as the amount has not been deducted from your bank account. If you wish to cancel a transfer, please contact Remit2Any by emailing their support team at help@remit2any.com for assistance.

How do I delete my Remit2Any account?

If you wish to delete your Remit2Any account, simply reach out to the Remit2Any support team by emailing help@remit2any.com. They will assist you in completing the account deletion process.

We always recommend keeping a copy of your transaction history in case you need it for future reference purposes. Once your account has been deleted, you will lose all access.

Additional Information

Legal and Regulatory Compliance

The legal name of the company is Remit2Any Inc., registered in the State of Washington, USA, with registration number 604871470. The company’s registered address is 3206 93rd PL SE, Everett, WA 98208.

Deals

Reviews

very seamless experience and one of the best exchange rate provider, always provide higher then google rate. and best part is zero txns fee and no hidden charge is there.

very smooth experience