Free Routing Number Lookup For US Banks And Credit Unions

Routing Numbers in the US are used for domestic money transfers and payments within the country. If you are looking for the Routing Number of your bank or credit union, we have you covered. Find the correct Routing Number of your financial institution below.

Routing Numbers: The Key To Streamlined US Banking

If you have a bank account in a US bank, credit union or financial institution, you have likely heard of Routing Numbers, also called ABA Routing Numbers.

Routing Numbers are 9-digit unique IDs for banks and financial institutions in the US, and help route money in-between bank accounts accurately and quickly. They are a foundational pillar of the US banking ecosystem, driving key functions like electronic transfers, direct deposits, bill payments and many other types of online transactions and payments.

If you need to look up the Routing Number for your bank or financial institution, check out the sections below. We may already have the Routing Numbers for your bank listed on our site; if not, we will show you how to easily look it up yourself.

Are You Looking For Routing Numbers For US Banks And Credit Unions?

We have compiled the list of Routing Numbers for various US Banks and Credit Unions. Click on your bank or credit union below to see the correct Routing Number for your financial institution.

The below list of US Banks and Credit Unions is alphabetically sorted so it is easier for you to find your financial institution below.

How To Find The Routing Number For Your Bank?

There are several quick and easy ways to find the Routing Number for your bank. Some of these include looking at the checks issued by your bank or visiting the website or mobile app of your bank.

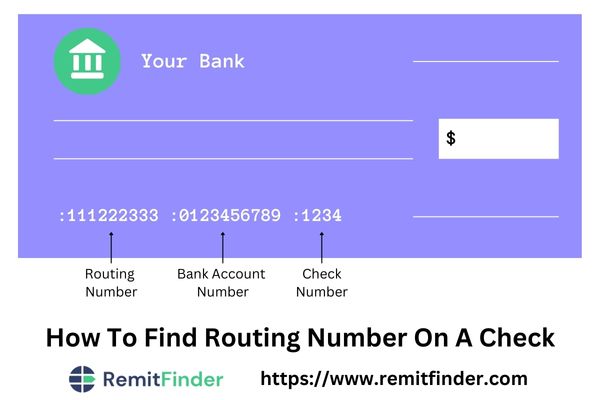

Where is the Routing Number of Your Bank on a Check?

Since Routing Numbers in the US follow the guidelines specified by the American Bankers Association (ABA), they are always printed in a standard format on checks issued by various banks, credit unions and financial institutions in the country.

As per the standard banking guidelines in the US, Routing Numbers (also called ABA Routing Numbers) are the first 9 digits printed on the bottom left of a check. The below image shows how to find the Routing Number for your bank using your check.

Routing Numbers in the US are always printed on checks as per ABA guidelines. The first 9 digits on the bottom left of checks issued by your bank represent their Routing Number.

Thanks to Routing Number standard guidelines published by the ABA, it is quick and easy to find the Routing Number for your bank via your check.

How to find the Routing Number of Your Bank without a Check?

Finding the Routing Number for your bank is simple and easy using your check, but what if you do not have access to your checkbook and need to find your Routing Number quickly? The good news is that there are many other easy ways to find the Routing Number for your bank.

Here are some other ways to find the Routing Number for your bank:

- Use the online banking portal or mobile apps of your bank to access your Routing Number.

- Call the customer service line of your bank and ask about your Routing Number.

- Visit the local branch of your bank to find out this information.

- Use this page to see if your bank is listed; if it is, simply click on the name of your bank to see their Routing Numbers.

In case you need the Routing Number of your bank to send and receive funds internationally, there are many other easy ways to do so. Instead of relying on your bank that may charge high fees and provide low exchange rates, you can use international money transfer companies to get the best exchange rates and pay low transfer fees.

What Is The Format Of A Routing Number?

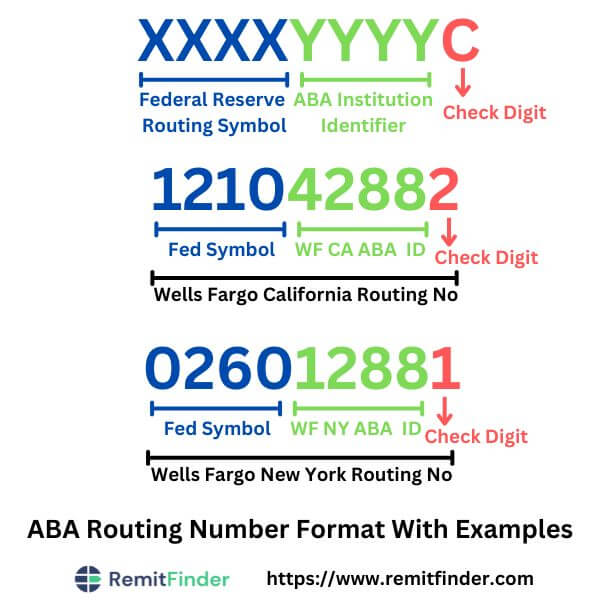

As per Routing Number guidelines published by the American Bankers Association (ABA), Routing Numbers in the US are always 9-digit long, and are made up of the following sub-parts:

- The first 4 digits represent the Federal Reserve Routing Symbol.

- The next 4 digits represent the ABA Institution Identifier with the Federal Reserve Bank.

- The last and 9th digit is a validation digit to ensure the accuracy of a Routing Number by making use of a validation algorithm.

Routing Numbers in the US are always 9 digits long. The information contains the Federal Reserve Routing Symbol in the first 4 digits, the ABA Institution Identifier of the bank with the Federal Reserve Bank in the next 4 digits and a validation digit as the last and 9th digit.

Here are a couple of examples of Routing Numbers from a popular US bank:

- Routing Number for Wells Fargo Bank in California is 121042882.

- Routing Number for Wells Fargo Bank in New York is 026012881.

The below image captures the format of a Routing Number along with our 2 examples in an infographic format.

There are a lot more details about Routing Numbers that you may be interested in. If so, check out our comprehensive guide to US Routing Numbers below.

Frequently Asked Questions About Routing Numbers Of Your Bank

What Is A Routing Number?

A Routing Number, also known as an ABA RTN (Routing Transit Number), is a unique 9-digit bank identification code used in the United States to facilitate the routing and processing of financial transactions. ABA stands for American Bankers Association which created the ABA specification and format back in 1910 to uniquely identify banks across the US.

What Is The Format Of A Routing Number?

As per Routing Number guidelines published by the American Bankers Association (ABA), Routing Numbers in the US are always 9-digit long, and are made up of the following sub-parts:

- The first 4 digits represent the Federal Reserve Routing Symbol.

- The next 4 digits represent the ABA Institution Identifier with the Federal Reserve Bank.

- The last and 9th digit is a validation digit to ensure the accuracy of a Routing Number by making use of a validation algorithm.

Can A Bank Or Financial Institution Have More Than One Routing Number?

The same bank or financial institution can have multiple Routing Numbers.

In fact, the ABA allows up to 9 additional ABA Routing Numbers to be assigned to a bank or financial institution if the latter requests them. The Routing Number Administrative Board of the ABA is the approving authority for banks or financial institutions requesting multiple ABA Routing Numbers.

What Is A Routing Number Used For?

Routing Numbers are very helpful anytime money needs to be routed between bank accounts held at various banks and financial institutions. This lends ABA Routing Numbers highly useful for many types of financial transactions; some of these include the below:

- Electronic Payments

- Direct Deposits

- Merchant Payments

- Online Banking

- Payment Gateways

How Can I Find A Routing Number?

There are several quick and easy ways to find the Routing Number for your bank or credit union. Some of these include looking at your checks or visiting your bank's website or mobile app.

Where is the Routing Number on a Check?

Since Routing Numbers in the US follow the guidelines specified by the American Bankers Association (ABA), they are always printed in a standard format on checks issued by various banks, credit unions and financial institutions in the country.

As per the standard banking guidelines in the US, Routing Numbers (also called ABA Routing Numbers) are the first 9 digits printed on the bottom left of a check.

How to find your Routing Number without a Check?

Finding your bank's Routing Number is simple and easy using your check, but what if you do not have access to your checkbook and need to find your Routing Number quickly? The good news is that there are many other easy ways to find Routing Numbers.

Here are some other ways to find a Routing Number:

- Use your bank's online banking portal or mobile apps to access your Routing Number.

- Call your bank's customer service and ask about your Routing Number.

- Visit your bank's local branch to find out this information.

- Use this page to see if your bank is listed; if it is, simply click on your bank's name to see the requisite Routing Numbers.

Is a Routing Number the same as a Bank Account Number?

A Routing Number is not the same as a bank account number as the 2 numbers represent different concepts.

If you have a US bank account, your bank will have a 9-digit Routing Number that helps to identify your bank in the country's banking ecosystem. Your account number, on the other hand, is specific and personal information for just your account.

Is a Routing Number the same as a SWIFT Code?

Routing Numbers and SWIFT Codes are both used in financial transactions, but they serve different purposes and operate in different systems. Here is a quick comparison between ABA Routing Numbers and SWIFT Codes:

ABA Routing Numbers:

- Used primarily in the United States for domestic transactions.

- Consist of 9 digits and are unique to each bank or financial institution.

- Identify the specific bank or financial institution within the US.

- Used for various transactions such as direct deposits, wire transfers, electronic payments and check processing within the US banking system.

- Ensure accurate routing and processing of funds within the US.

SWIFT Codes:

- Used internationally for cross-border transactions.

- Also known as Bank Identifier Codes (BICs).

- Consist of a combination of 8 or 11 alphanumeric characters.

- Identify the bank and branch involved in international financial transactions.

- Used for international wire transfers, foreign currency exchange and communication between financial institutions globally.

- Facilitate secure and standardized transactions across different countries and currencies.

Is it Safe to Share a Routing Number?

If you are a bank account holder in the United States, your bank or credit union will have a Routing Number. Routing Numbers are specific to banks and are public information. In that sense, it is safe to share a Routing Number.

Are Routing Numbers used outside of the US?

The Routing Number specification was developed by the ABA for use within the US banking ecosystem to uniquely identify banks and financial institutions participating in financial transactions within the country.

Given this, Routing Numbers are not used outside of the US. You may still hear of them outside the US as international transactions may finally get cleared by local US banks that might use a recipient's bank's Routing Number to move the money into their account.